A Claims-made policy responds to Claims or notifications that are reported to the insurer while the policy is active, provided the Retroactive date covers the period when the alleged act occurred.

For a Claim to be accepted by the Insurer:

- The policy must cover the time when the act/incident occurred (Retroactive cover)

- The policy must be active when you make the Claim

It is easy to inadvertently make a change to a Claims-made insurance policy that will prevent you from being able to make a Claim in the future.

The most common mistake is cancelling your policy (or allowing it to expire) too early.

Claims-made policies cover risks where the actual Claim may not surface until long after the event that is the cause of the Claim (an act, omission, service, advice, decision, event, etc.) occurs. This long-lasting risk is what separates Claims-made policies from the more common occurrence-based policies.

The most common types of policies that are 'written on' a claims-made basis are:

- Professional Indemnity

- Directors and Officers Liability

- Employment Practices Liability

- Association Liability

- Management Liability

- Cyber Liability

- Medical Malpractice

- Environmental Liability

- Statutory Liability

- Tax Audit

For these types of policies, it is essential that:

- There are no breaks in coverage (commonly referred to as Continuity of Coverage)

- Appropriate Retroactive cover is in place

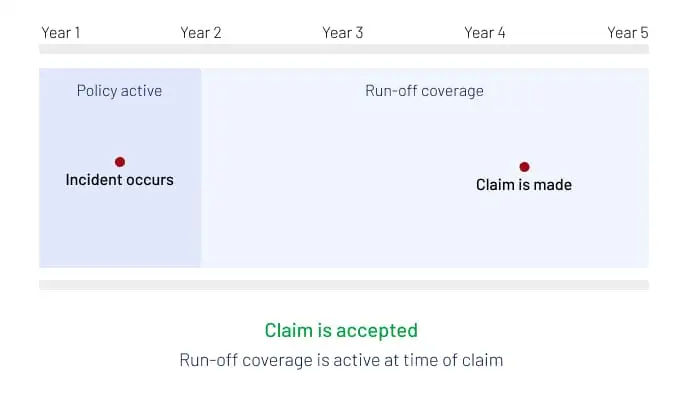

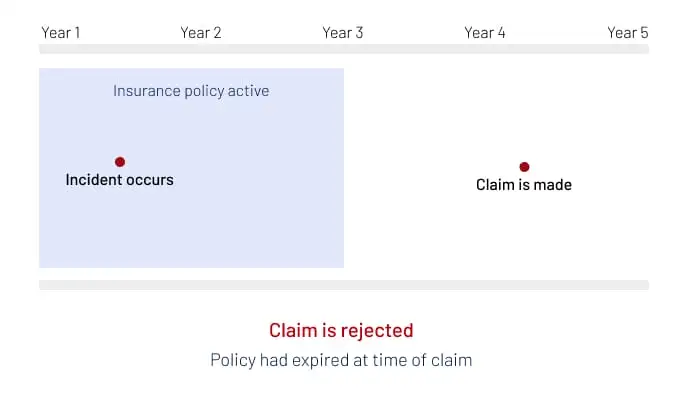

Claims-made policy coverage examples

Here are some examples which demonstrate how Claims-made coverage applies.

In the example above, the Claim is accepted because both criteria were met: the policy was active when the Claim was made and the Retroactive date preceded the incident that caused the Claim.

In this example, the Claim is not accepted. While the policy was active when the incident occurred, it was not active when the Claim was made.

Run-off coverage

Sometimes referred to as tail coverage, Run-Off coverage comes in to play when you no longer operate a business, provide a service, or give professional advice. This most often occurs when you retire (or resign as a director), sell the business, or cease trading.

Under the Statute of Limitations, your liability for actions made whilst you were “in business” remain in place for at least 7 years after you have ceased being “in business”.

Run-off policies extend the cover provided by your expiring policy for up to 7 years for the business activities performed prior to the “Run-Off date” (the date you ceased being “in business”). Run-off policies can be purchased for between 1 and 7 years.

In this example the Claim is accepted because the Claim is made during the Run-Off policy period and the incident occurred during the Retroactive period.

In this example, the Claim is not accepted. While the policy was active when the incident occurred, it was not active when the Claim was made as no Run-Off policy was purchased.

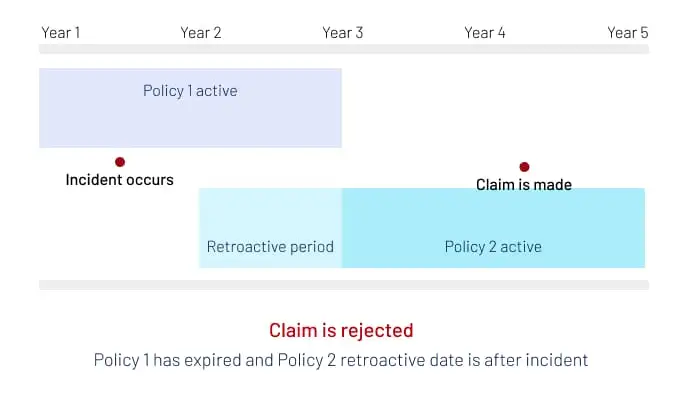

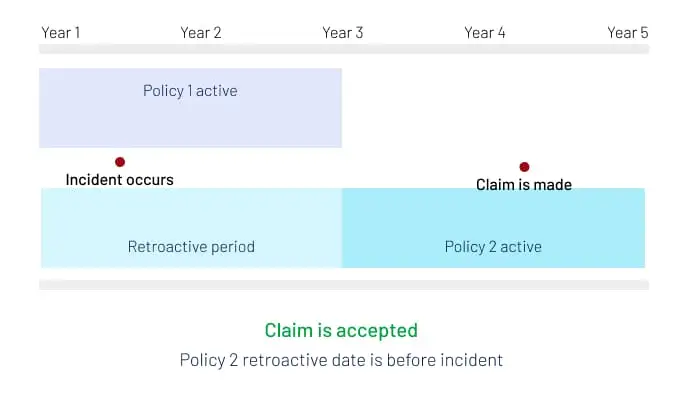

Retroactive cover

With Claims-made policies it is essential that there are no lapses in coverage and that the Retroactive date is aligned with when the business first began or is shown as Unlimited in the policy schedule.

This concept is most relevant when changing Insurers on the same type of policy. It may be tempting to change to a new Insurer with a cheaper premium, but if the new policy doesn't cover the same retroactive period of time as the old policy, you will be exposing yourself to uninsured risk.

In the example above, the Retroactive date of the new policy does not cover when the incident occurred, so the Claim will be declined. This is an example of when continuous coverage is not provided because the Insurer changed and the Retroactive period was not in line with the previous policy.

In this example, the Retroactive period covers when the incident occurred, so continuous coverage is maintained and the Claim is accepted.

Common Oversights

There are several common oversights that businesses make relating to Claims-made policies that leave them exposed.

Retirement

If you cancel your policy when you retire you will have no coverage for any future Claims that arise. Obtaining Run-Off cover for 7 years is the only way obtain ongoing policy protection.

Mergers and Acquisitions

The same concept applies to mergers or acquisitions. If you sell your business, you are still liable for the actions of the business while you were the owner. The solution is to obtain Run-Off cover.

Reduced Service

If your business changes or reduces your service offerings, you still need coverage in place for any discontinued services. You are still liable for the consequences of those services for the time that you did offer them. You can usually obtain Run-Off cover within your ongoing policy for these discontinued services or take a separate Run-Off policy for them.

Increasing insurance to secure a new contract

It's common for new contracts to have conditions requiring both parties to have insurance policies in place for up to 7 years for the contract to proceed. Many business owners are happy to increase their coverage, and premiums, to secure a new contract.

What they often don't realise is that the increased insurance premiums aren't temporary. They can't just cancel the policy when the work is finished, or they lose coverage entirely and violate the terms of the contract. They need to maintain the higher level of insurance for the period of time specified in the contract. This should be considered when pricing for the contract so that profits are not impacted by the ongoing increased premiums.

Seek advice

Claims-made policies offer essential protection for professionals and businesses exposed to long-tail risks, but they require careful management.

Whether you're retiring, restructuring, or switching insurers, understanding the mechanics of Claims-made insurance helps avoid costly gaps and ensures you're protected when it matters most.

If you're unsure whether your current policy meets your long-term needs, speak with us to review your coverage and explore options for Run-Off or Retroactive protection. The right advice today can safeguard your future tomorrow.

The information on this page is intended for general educational purposes and necessarily simplifies some concepts for clarity. Insurance policies can differ widely between insurers, policy types, and jurisdictions. For guidance on your specific circumstances, you should review your policy documents carefully and consult a qualified insurance adviser, broker, or legal professional.